I attended a Citizens Property Insurance Round Table sponsored by State Representative Frank Artiles and Senator Oscar Braynon to discuss the proposed changes to Citizens’ current 10% rate increase cap. In an attempt to decrease the State of Florida’s financial exposure in the event of a major hurricane, Citizens has already removed some 17,000 policies from their coverage, eliminated or modified the amounts that will be deducted from a homeowners premium for mitigation upgrades, tightened their requirements on insurance based on useful life of the roof, and raised premiums. They no longer insure properties over $1 million.

Although I understand that the State of Florida does not, and probably should not, want to be in the insurance business, there are no other viable alternatives for windstorm protection in this state. If Citizens is allowed to remove the current cap on increases, premiums for coverage in South Florida could jump between 50 and 95%. Buyers who recently purchased their homes or investment properties could be in a situation where their insurance premiums go up to the point where their planned housing budgets get thrown completely out the window. I have several buyers who, after qualifying for Citizens for their purchase, were contacted a couple of months after they closed to be told that they need another inspection or were dropped when their policy came up for renewal.

For the 31.4% of homeowners in Florida with mortgages under water, and the 10.1% of those who are 90 days behind on their mortgages, the current and proposed changes, are just one more huge financial hurdle for them to overcome.

Several issues were raised during the round table that need addressing:

1) Currently, Citizens offers more than just windstorm insurance. Why the state should be insuring against a home’s plumbing leaks and other non-nature related claims, which happen more frequently than “the big one” is beyond me. Citizens should only be for windstorm and maybe sinkhole insurance.

2) Although there have been way more storms in northern Florida counties, and all 67 counties in the state are prone to a direct hit, the southern counties would be paying much higher premiums for same priced properties.

3) Citizens got rid of the appraisal value for another mechanism of figuring out replacement value, even though their mechanism results in significantly higher replacement costs and therefore higher premiums.

4) Citizens has spent a huge amount of money in legal fees fighting claims. If the claims are fraudulent, I am all for it, but it appears these are claims that they are supposed to be paying.

5) The need for national disaster insurance coverage that covers all natural disasters from flooding to tornadoes, hurricanes and earthquakes. If you look at the map from NOAA below, most states along the Gulf and east Coast have been hit by hurricanes. I wonder what their states’ insurance looks like?

If you are looking for reliable insurance agents who are well informed on the current and proposed changes to Citizens and who have other insurers available, contact Phil Lyons at Insource or Alvaro Murillo at Macpherson Insurance Agency. Please share your comments and concerns regarding Citizens insurance. The Miami and Florida Association of Realtors are following this issue very closely. You can also send your suggestions to Citizens at [email protected].

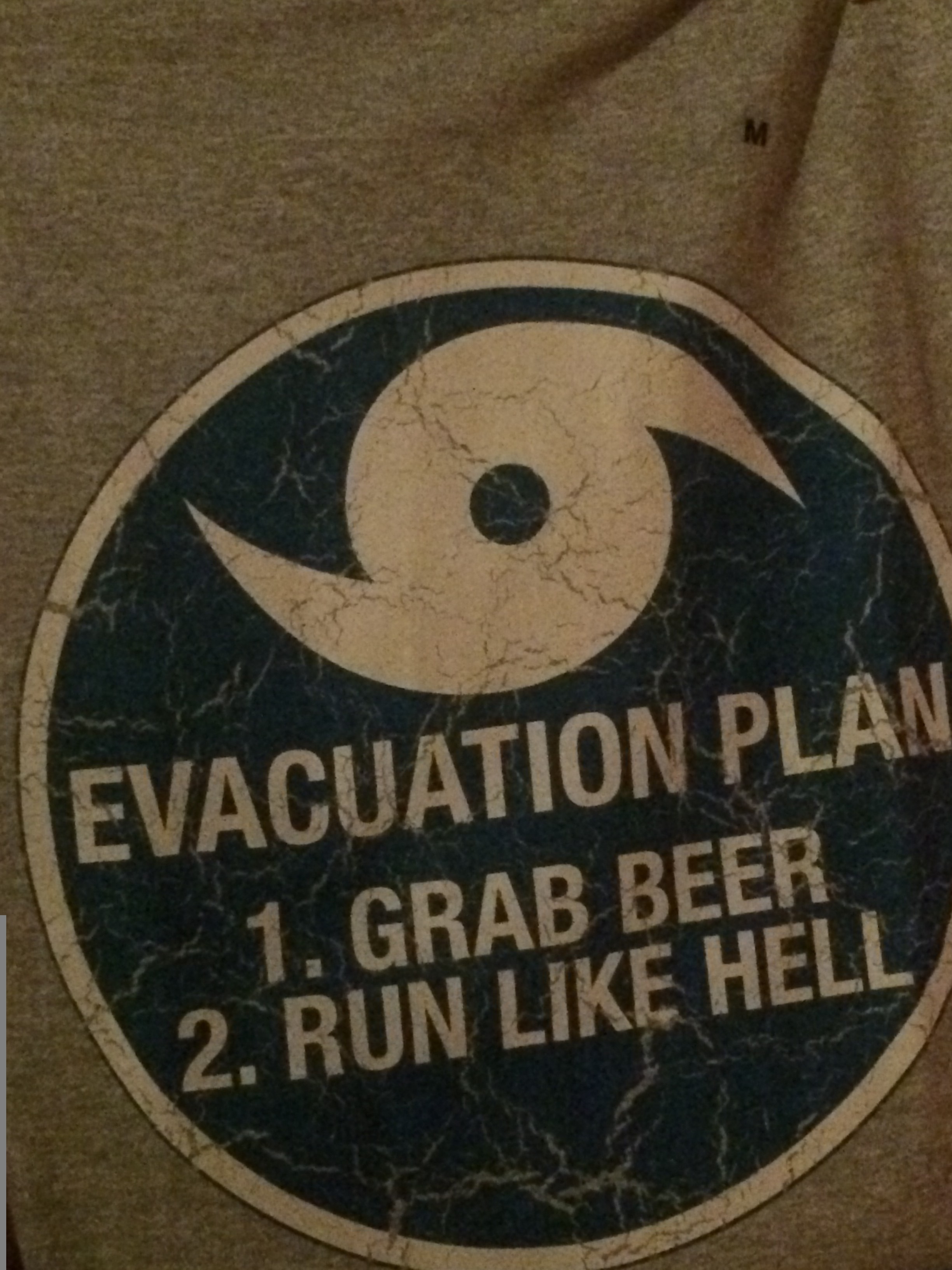

![IMG_0555[1]](https://ilovesofla.com/wp-content/uploads/2013/12/IMG_05551-e1388528106485-225x300.jpg) Although this is obviously a joke and not a real evacuation plan, everyone who lives in the State of Florida should have a real evacuation plan by now. If you have been postponing making one because we have been lucky and haven’t had a hurricane strike in Florida for years, you should at least have a basic hurricane plan and some of the general supplies on hand . The last thing you want to do when a warning is upon us is to be scrambling for supplies.

Although this is obviously a joke and not a real evacuation plan, everyone who lives in the State of Florida should have a real evacuation plan by now. If you have been postponing making one because we have been lucky and haven’t had a hurricane strike in Florida for years, you should at least have a basic hurricane plan and some of the general supplies on hand . The last thing you want to do when a warning is upon us is to be scrambling for supplies.