One of my favorite things about living in South Florida is how easy it is to travel anywhere from here. Miami International Airport (MIA) is one of the busiest airports in the country with over 80 airlines serving 150+ places around the world. We also have the Fort Lauderdale and Palm Beach airports, so plenty of airlines and airfares to choose from.

This year, my family was invited to a wedding in Lima, Peru. What an amazing country! They truly understand the meaning of customer service. Miami’s hospitality industry can definitely learn something from the Peruvians.

After the wedding, we took a side trip to Cusco and stayed at this amazing hotel, the Antigua Casona. From a real estate perspective, it was incredibly interesting as the owners rebuilt a falling down house into this intimate, boutique hotel. That in and of itself is enough for an entire blog post, but I’ll save that portion for another day.

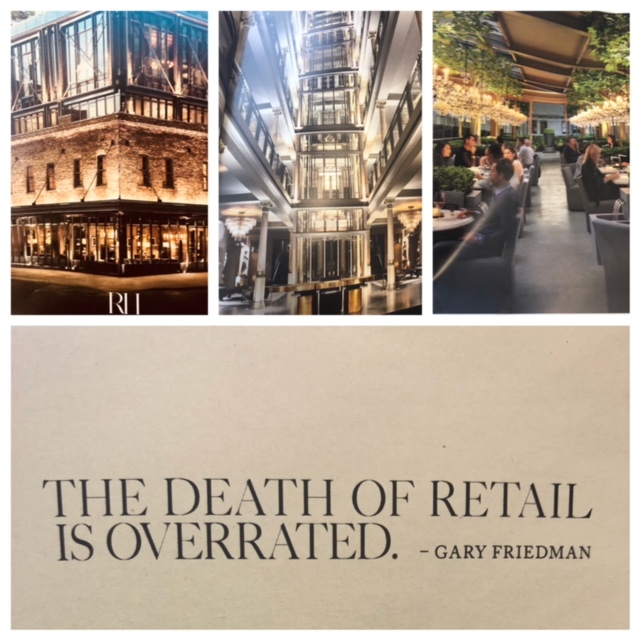

What I found so compelling about this hotel was how they managed to integrate the local artwork,

the theme of the area (Incan architecture), the weather and altitude (almost 15,000 feet above sea level, which is rough on Miamians) and the food into an overall incredible experience.

Leaving the hotel at 5:00 a.m. for a Machu Picchu trek? No worries they have a picnic breakfast ready for you. Being affected by the altitude? Again, no worries, every night they bring a thermos with hot water and a local mint tea to help with the effects. In the morning, they have a coca tea to help. A little chilly? Every evening with the tea service, they place covered hot water bottles under the covers on each side of the bed.

The customer service and the attention to detail, anticipating what the client might want or need was beyond anything I have experienced in my travels and made me wonder, do I go far enough in providing that experience to my real estate customers? Does my company? If not, how can we do better?